The importance of bookkeeping for small businesses

Bookkeeping is a critical aspect of running a successful small business in the USA. It involves the systematic recording, organizing, and maintaining of financial transactions, including income, expenses, assets, and liabilities. Accurate bookkeeping is essential for making informed business decisions, complying with tax regulations, and securing funding or loans.

In the fast-paced and competitive business landscape, small business owners often find themselves juggling multiple responsibilities, from managing operations to marketing and sales. Attempting to handle bookkeeping tasks on top of these demands can be overwhelming and increase the risk of errors or oversights.

Neglecting proper bookkeeping can lead to significant consequences, such as:

- Inaccurate financial statements

- Missed tax deadlines and penalties

- Difficulty in securing financing or investments

- Inability to track business performance and make data-driven decisions

By outsourcing bookkeeping to professionals, small business owners can focus on their core competencies and strategic growth initiatives, while ensuring their financial records are accurate and up-to-date.

Benefits of professional bookkeeping services

Hiring professional small business bookkeeping services in USA can provide numerous advantages for small businesses in the USA. Here are some key benefits:

- Expertise and Accuracy: Professional bookkeepers have extensive knowledge and experience in handling financial records, ensuring accuracy and compliance with accounting standards and tax regulations.

- Time-Saving: By delegating bookkeeping tasks to professionals, small business owners can free up valuable time to concentrate on other critical aspects of their operations, such as product development, marketing, and customer relationships.

- Cost-Effective: Outsourcing bookkeeping services can be more cost-effective than hiring a full-time in-house accountant, especially for small businesses with limited resources.

- Access to Advanced Software and Tools: Professional bookkeeping firms often utilize the latest accounting software and tools, which can streamline processes, improve data management, and provide real-time financial insights.

- Scalability: As your small business grows, professional bookkeeping services can easily scale their support to accommodate increasing transaction volumes and financial complexities.

- Objective Financial Insights: An external bookkeeping service can provide an objective perspective on your business’s financial health, identifying areas for improvement and potential cost-saving opportunities.

- Peace of Mind: By entrusting your financial records to professionals, you can have peace of mind knowing that your bookkeeping is handled accurately and in compliance with relevant regulations.

Common bookkeeping challenges faced by small businesses

Small business owners often encounter various challenges when it comes to bookkeeping. Some common issues include:

- Limited Time and Resources: As a small business owner, you may find yourself stretched thin, juggling multiple responsibilities and lacking dedicated time and resources for bookkeeping tasks.

- Lack of Accounting Knowledge: Unless you have a background in accounting or finance, navigating the complexities of bookkeeping, tax regulations, and financial reporting can be daunting.

- Maintaining Accurate Records: Manually tracking and recording transactions can be prone to errors, leading to inaccuracies in financial statements and potential compliance issues.

- Keeping Up with Changing Regulations: Tax laws and accounting standards are constantly evolving, and staying up-to-date with these changes can be challenging for small business owners.

- Separating Personal and Business Finances: Mixing personal and business finances can create confusion and make it difficult to track expenses, income, and tax liabilities accurately.

- Cash Flow Management: Maintaining a healthy cash flow is crucial for small businesses, and proper bookkeeping practices can help identify potential cash flow issues and facilitate better financial planning.

- Scalability Challenges: As your small business grows, managing bookkeeping tasks can become increasingly complex, requiring more time, resources, and expertise.

By outsourcing bookkeeping to professionals, small business owners can overcome these challenges and focus on growing their businesses while ensuring accurate financial records and compliance.

How professional bookkeeping services can help small businesses in the USA

Professional bookkeeping services can provide invaluable support to small businesses in the USA, offering a range of solutions tailored to their specific needs. Here’s how these services can benefit your business:

- Accurate Financial Reporting: Experienced bookkeepers ensure that all financial transactions are accurately recorded, classified, and reported in accordance with generally accepted accounting principles (GAAP) and relevant tax laws.

- Tax Compliance Assistance: Professional bookkeeping services can help small businesses stay compliant with federal, state, and local tax regulations. They can prepare and file tax returns, handle payroll taxes, and ensure accurate reporting to avoid penalties and audits.

- Cash Flow Management: By maintaining up-to-date financial records, bookkeepers can provide valuable insights into your business’s cash flow, helping you identify potential shortfalls or opportunities for better cash management.

- Financial Analysis and Forecasting: Bookkeeping services can analyze your financial data, identify trends, and provide forecasts to support informed decision-making and strategic planning.

- Payroll and Accounts Payable/Receivable Management: Professional bookkeepers can handle payroll processing, track accounts payable and receivable, and ensure timely payments and collections, minimizing the risk of late fees or missed payments.

- Customized Reporting and Insights: Bookkeeping firms can provide customized reports and dashboards tailored to your specific business needs, giving you a comprehensive view of your financial performance and enabling data-driven decision-making.

- Scalability and Growth Support: As your small business expands, professional bookkeeping services can easily scale their support to accommodate increased transaction volumes, new business lines, or additional reporting requirements.

By leveraging the expertise and resources of professional bookkeeping services, small businesses in the USA can streamline their financial operations, ensure compliance, and gain valuable insights to drive growth and success.

Factors to consider when hiring a bookkeeping service for your small business in the USA

When selecting a bookkeeping service for your small business in the USA, it’s essential to consider several factors to ensure a successful partnership. Here are some key considerations:

- Experience and Qualifications: Look for a bookkeeping service with experienced professionals who have a strong background in small business accounting and are knowledgeable about the latest tax laws and regulations in your industry.

- Reputation and References: Research the bookkeeping service’s reputation by reading online reviews, checking their credentials, and requesting references from current or past clients, especially those in your industry or with similar business needs.

- Service Offerings: Evaluate the range of services offered by the bookkeeping firm to ensure they align with your specific needs, such as accounts payable/receivable management, payroll processing, tax preparation, financial reporting, and advisory services.

- Technology and Software: Inquire about the bookkeeping service’s use of advanced accounting software and tools, as well as their data security measures to protect your financial information.

- Communication and Responsiveness: Effective communication is crucial in a bookkeeping partnership. Consider the service’s responsiveness, availability for consultations, and their ability to provide clear and concise financial reports and insights.

- Pricing and Cost-Effectiveness: Compare pricing structures and packages from multiple bookkeeping services to find a cost-effective solution that fits your budget while providing the necessary level of support and expertise.

- Scalability and Growth Support: As your small business grows, ensure that the bookkeeping service can accommodate increasing transaction volumes, new business lines, or additional reporting requirements without disrupting your operations.

- Industry Expertise: If your small business operates in a specialized industry, consider bookkeeping services with experience and knowledge specific to your sector, as they may better understand the unique accounting and compliance requirements.

By carefully evaluating these factors, you can increase the chances of finding a reliable and trustworthy bookkeeping service that aligns with your small business’s needs and goals, enabling you to focus on growth and success.

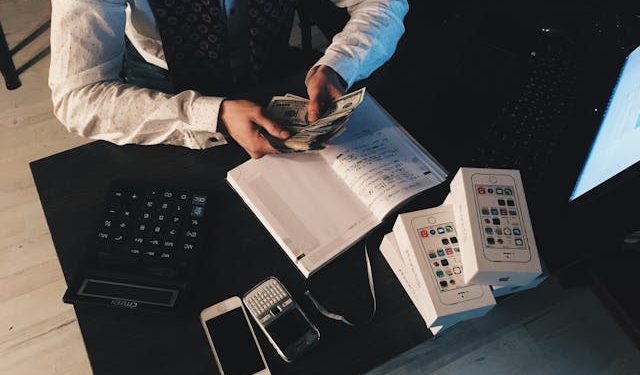

Image Source: Unsplash

The importance of bookkeeping for small businesses

Bookkeeping is a critical aspect of running a successful small business in the USA. It involves the systematic recording, organizing, and maintaining of financial transactions, including income, expenses, assets, and liabilities. Accurate bookkeeping is essential for making informed business decisions, complying with tax regulations, and securing funding or loans.

In the fast-paced and competitive business landscape, small business owners often find themselves juggling multiple responsibilities, from managing operations to marketing and sales. Attempting to handle bookkeeping tasks on top of these demands can be overwhelming and increase the risk of errors or oversights.

Neglecting proper bookkeeping can lead to significant consequences, such as:

- Inaccurate financial statements

- Missed tax deadlines and penalties

- Difficulty in securing financing or investments

- Inability to track business performance and make data-driven decisions

By outsourcing bookkeeping to professionals, small business owners can focus on their core competencies and strategic growth initiatives, while ensuring their financial records are accurate and up-to-date.

Benefits of professional bookkeeping services

Hiring a professional bookkeeping service can provide numerous advantages for small businesses in the USA. Here are some key benefits:

- Expertise and Accuracy: Professional bookkeepers have extensive knowledge and experience in handling financial records, ensuring accuracy and compliance with accounting standards and tax regulations.

- Time-Saving: By delegating bookkeeping tasks to professionals, small business owners can free up valuable time to concentrate on other critical aspects of their operations, such as product development, marketing, and customer relationships.

- Cost-Effective: Outsourcing bookkeeping services can be more cost-effective than hiring a full-time in-house accountant, especially for small businesses with limited resources.

- Access to Advanced Software and Tools: Professional bookkeeping firms often utilize the latest accounting software and tools, which can streamline processes, improve data management, and provide real-time financial insights.

- Scalability: As your small business grows, professional bookkeeping services can easily scale their support to accommodate increasing transaction volumes and financial complexities.

- Objective Financial Insights: An external bookkeeping service can provide an objective perspective on your business’s financial health, identifying areas for improvement and potential cost-saving opportunities.

- Peace of Mind: By entrusting your financial records to professionals, you can have peace of mind knowing that your bookkeeping is handled accurately and in compliance with relevant regulations.

Common bookkeeping challenges faced by small businesses

Small business owners often encounter various challenges when it comes to bookkeeping. Some common issues include:

- Limited Time and Resources: As a small business owner, you may find yourself stretched thin, juggling multiple responsibilities and lacking dedicated time and resources for bookkeeping tasks.

- Lack of Accounting Knowledge: Unless you have a background in accounting or finance, navigating the complexities of bookkeeping, tax regulations, and financial reporting can be daunting.

- Maintaining Accurate Records: Manually tracking and recording transactions can be prone to errors, leading to inaccuracies in financial statements and potential compliance issues.

- Keeping Up with Changing Regulations: Tax laws and accounting standards are constantly evolving, and staying up-to-date with these changes can be challenging for small business owners.

- Separating Personal and Business Finances: Mixing personal and business finances can create confusion and make it difficult to track expenses, income, and tax liabilities accurately.

- Cash Flow Management: Maintaining a healthy cash flow is crucial for small businesses, and proper bookkeeping practices can help identify potential cash flow issues and facilitate better financial planning.

- Scalability Challenges: As your small business grows, managing bookkeeping tasks can become increasingly complex, requiring more time, resources, and expertise.

By outsourcing bookkeeping to professionals, small business owners can overcome these challenges and focus on growing their businesses while ensuring accurate financial records and compliance.

How professional bookkeeping services can help small businesses in the USA

Professional bookkeeping services can provide invaluable support to small businesses in the USA, offering a range of solutions tailored to their specific needs. Here’s how these services can benefit your business:

- Accurate Financial Reporting: Experienced bookkeepers ensure that all financial transactions are accurately recorded, classified, and reported in accordance with generally accepted accounting principles (GAAP) and relevant tax laws.

- Tax Compliance Assistance: Professional bookkeeping services can help small businesses stay compliant with federal, state, and local tax regulations. They can prepare and file tax returns, handle payroll taxes, and ensure accurate reporting to avoid penalties and audits.

- Cash Flow Management: By maintaining up-to-date financial records, bookkeepers can provide valuable insights into your business’s cash flow, helping you identify potential shortfalls or opportunities for better cash management.

- Financial Analysis and Forecasting: Bookkeeping services can analyze your financial data, identify trends, and provide forecasts to support informed decision-making and strategic planning.

- Payroll and Accounts Payable/Receivable Management: Professional bookkeepers can handle payroll processing, track accounts payable and receivable, and ensure timely payments and collections, minimizing the risk of late fees or missed payments.

- Customized Reporting and Insights: Bookkeeping firms can provide customized reports and dashboards tailored to your specific business needs, giving you a comprehensive view of your financial performance and enabling data-driven decision-making.

- Scalability and Growth Support: As your small business expands, professional bookkeeping services can easily scale their support to accommodate increased transaction volumes, new business lines, or additional reporting requirements.

By leveraging the expertise and resources of professional bookkeeping services, small businesses in the USA can streamline their financial operations, ensure compliance, and gain valuable insights to drive growth and success.

Key features to look for in a bookkeeping service for small businesses

When choosing a professional bookkeeping service for your small business, it’s essential to consider the key features and capabilities that will best support your financial operations and growth. Here are some crucial features to look for:

- Cloud-Based Platform: A cloud-based bookkeeping solution offers several advantages, including remote access, real-time data updates, and automatic backups, ensuring your financial information is always secure and accessible.

- Integration with Accounting Software: Look for a bookkeeping service that seamlessly integrates with popular accounting software like QuickBooks, Xero, or FreshBooks. This integration streamlines data entry, reduces manual work, and ensures accurate and up-to-date financial records.

- Customizable Reporting and Dashboards: Customizable reporting and dashboards allow you to gain valuable insights into your business’s financial performance, tailored to your specific needs and key performance indicators (KPIs).

- Tax Compliance Support: Ensure the bookkeeping service offers comprehensive tax compliance support, including tax planning, preparation, and filing services for federal, state, and local taxes.

- Payroll and HR Management: Many small businesses require payroll and human resources (HR) management services. Look for a bookkeeping service that can handle payroll processing, tax filings, and HR-related tasks like employee onboarding and benefits administration.

- Advisory and Consulting Services: In addition to bookkeeping, consider services that offer advisory and consulting services to help you make informed business decisions, optimize financial processes, and identify growth opportunities.

- Scalability and Flexibility: As your small business grows, your bookkeeping needs may change. Choose a service that can easily scale its offerings and adapt to your evolving requirements, ensuring a seamless transition and uninterrupted support.

- Data Security and Compliance: Ensure the bookkeeping service prioritizes data security and complies with relevant regulations and industry standards, such as GDPR, HIPAA, or PCI-DSS, to protect your sensitive financial information.

- Customer Support and Communication: Evaluate the bookkeeping service’s customer support channels, response times, and communication methods to ensure you receive prompt assistance and clear communication regarding your financial records and reports.

By considering these key features, you can select a bookkeeping service that not only meets your current needs but also supports your small business’s long-term growth and success.

How to choose the right bookkeeping service for your small business in the USA

Choosing the right bookkeeping service for your small business in the USA is a critical decision that can have a significant impact on your financial operations and overall success. Here are some steps to help you navigate the selection process:

- Assess Your Business Needs: Start by evaluating your small business’s specific bookkeeping and financial management requirements. Consider factors such as the volume of transactions, industry-specific regulations, growth plans, and the level of support you need.

- Research and Compare Services: Create a list of potential bookkeeping services that cater to small businesses in the USA. Research their offerings, pricing structures, and customer reviews to narrow down your options.

- Evaluate Expertise and Qualifications: Ensure the bookkeeping service you choose has experienced professionals with relevant qualifications and certifications, such as Certified Public Accountants (CPAs) or Certified Bookkeepers.

- Consider Industry Specialization: If your small business operates in a specialized industry, prioritize bookkeeping services with expertise and knowledge specific to your sector, as they will better understand the unique accounting and compliance requirements.

- Assess Technology and Software Integration: Evaluate the bookkeeping service’s use of advanced accounting software and tools, as well as their ability to integrate with your existing systems or platforms.

- Review Data Security and Privacy Measures: Data security and privacy should be a top priority when handling sensitive financial information. Ensure the bookkeeping service has robust security measures in place, such as encryption, access controls, and compliance with relevant regulations.

- Understand Communication and Reporting Processes: Effective communication is crucial in a bookkeeping partnership. Assess the service’s communication channels, reporting formats, and responsiveness to ensure a seamless collaboration.

- Request References and Case Studies: Ask for references from current or past clients, especially those with similar business needs or in your industry. Review case studies or success stories to understand the service’s track record and capabilities.

- Evaluate Pricing and Value: While cost is an important consideration, avoid making decisions solely based on price. Instead, evaluate the overall value proposition, including the service offerings, expertise, and long-term benefits for your small business.

- Schedule Consultations and Ask Questions: Finally, schedule consultations or meetings with your top choices to discuss your specific needs, ask questions, and gauge the service provider’s professionalism and fit for your small business.

By following these steps and carefully evaluating your options, you can increase the chances of finding a trustworthy and reliable bookkeeping service that aligns with your small business’s goals, enabling you to focus on growth and success.

Cost-effective bookkeeping solutions for small businesses in the USA

For small businesses in the USA, finding cost-effective bookkeeping solutions is crucial to managing expenses while ensuring accurate financial records and compliance. Here are some strategies to consider:

- Outsourcing to Virtual Bookkeepers: Virtual bookkeeping services can be a cost-effective alternative to hiring an in-house bookkeeper or accountant. These services often offer flexible pricing models based on the volume of transactions or services required, allowing you to pay only for what you need.

- Utilizing Cloud-Based Accounting Software: Cloud-based accounting software, such as QuickBooks Online, Xero, or FreshBooks, can streamline bookkeeping processes and reduce the need for manual data entry. Many of these platforms offer affordable subscription plans tailored to small businesses.

- Leveraging Accounting Freelancers: Freelance bookkeepers and accountants can be a cost-effective option for small businesses with varying or seasonal bookkeeping needs. You can hire them on a project or hourly basis, avoiding the overhead costs associated with full-time employees.

- Bundling Services with Accounting Firms: Accounting services for small business in USA offer bundled services that include bookkeeping, tax preparation, and advisory services at a discounted rate. This can be a cost-effective solution for small businesses that require a comprehensive range of financial services.

- Automating Routine Tasks: Explore automation tools and integrations that can streamline routine bookkeeping tasks, such as expense tracking, invoicing, and bank reconciliations. This can reduce manual efforts and the associated costs.

- Utilizing Student or Intern Resources: Consider partnering with local colleges or universities to hire accounting students or interns for bookkeeping tasks. While they may require more supervision, this can be a cost-effective way to access skilled resources at a lower cost.

- Negotiating Customized Packages: When engaging with bookkeeping services, negotiate customized packages that align with your specific needs and budget. Many providers are willing to tailor their offerings to meet the unique requirements of small businesses.

- Leveraging Small Business Accounting Resources: Take advantage of free or low-cost resources specifically designed for small business owners, such as online tutorials, webinars, and educational materials provided by accounting organizations or government agencies.

By exploring these cost-effective strategies, small businesses in the USA can access professional bookkeeping services without compromising on quality or accuracy, while maintaining a balanced budget and focusing on growth opportunities.

Conclusion: Achieving small business success through professional bookkeeping services

In the dynamic and competitive landscape of small businesses in the USA, accurate and efficient bookkeeping is a critical component for success. By partnering with professional bookkeeping services, small business owners can alleviate the burdens of financial record-keeping, ensure compliance with tax regulations, and gain valuable insights for informed decision-making.**The Importance of Hiring an Accountant for Small Business Success**

As a small business owner, your time and expertise are best invested in core operations, product development, and customer relationships. By outsourcing bookkeeping to professionals, you can focus on driving growth while ensuring your financial records are accurate, up-to-date, and compliant with relevant regulations.

Hiring an accountant or bookkeeping service can provide numerous benefits, including:

- Access to expert knowledge and industry best practices

- Time savings to concentrate on revenue-generating activities

- Improved financial management and cash flow visibility

- Reduced risk of errors, penalties, and compliance issues

- Scalable support as your business grows and evolves

Don’t underestimate the value of accurate financial records and professional guidance. Invest in a reputable bookkeeping service today and position your small business for long-term success in the competitive USA market.

Professional bookkeeping services offer tailored solutions to meet the unique needs of small businesses, from basic transaction recording to advanced financial analysis and forecasting. By leveraging their expertise and resources, small business owners can streamline financial operations, mitigate risks, and unlock valuable insights for strategic decision-making.

As your small business continues to grow and evolve, a reliable bookkeeping partner can provide the support and scalability needed to navigate financial complexities, ensuring compliance and positioning your business for sustained success in the competitive USA market.

Embrace the benefits of professional bookkeeping services and unlock the full potential of your small business today. Hire an accountant With accurate financial records and expert guidance, you can confidently navigate the challenges and seize the opportunities that lie ahead, paving the way for long-term growth and prosperity.